Savings

planning tool

Calculate how much you need to save each month to achieve your savings goal!

Create a savings plan now to know how much you need to save each month!

Online savings planning tool: Determine the amount of money you need to save each month to achieve your goals.

Saving money is an important factor in ensuring personal financial security and building a stable future. However, many people still struggle with planning and managing their finances. That's why the savings planning tool at VietnamSalary.vn, which applies compound interest, is an effective tool to help you specify your saving goals more accurately.

The compound interest savings plan tool uses the formula for compound interest to calculate the growth rate of the principal and interest of the savings during the investment period. By entering the initial savings amount, interest rate, and desired investment period, the tool will calculate the monthly savings amount needed to achieve your savings goal.

With the compound interest savings plan tool, you can:

- Determine your savings goal and plan to achieve it accurately and efficiently.

- Calculate the monthly savings amount needed to achieve your savings goal.

- Evaluate the growth rate of your savings during the investment period.

- Evaluate and adjust your savings plan to achieve your financial goals.

With the compound interest savings plan tool, managing and planning your savings becomes easier and more efficient than ever.

Planning savings by depositing money into a savings account:

When it comes to saving money, planning is an extremely important factor. Planning your savings helps you have a clear and specific strategy to achieve your financial goals. In particular, depositing money into a savings account is a common and effective method to start your savings journey.

When you deposit money into a savings account, you not only keep your money safe but also earn interest on that amount. This helps your savings grow over time to achieve your savings goals or simply serve as a financial cushion for the future. Additionally, planning your savings allows you to manage your personal finances in a structured manner to achieve various life goals such as buying a house, purchasing a car, early retirement, accumulating wealth, and more.

Methods to calculate the amount needed to achieve savings goals:

To calculate the amount needed to achieve your savings goals, there are several effective methods you can apply:

- Percentage method:

- Fixed amount method:

- Time target method

- Reverse accumulation method:

Set a percentage of your monthly income to save. For example, you can decide to save 20% of your monthly income.

Set a fixed amount that you will save each month, regardless of your income. This helps ensure that you always have a consistent savings amount.

Determine the timeframe in which you want to achieve your savings goal and calculate the amount you need to save monthly to reach that goal within that timeframe.

Start with your savings goal and calculate the amount you need to save monthly. Then, adjust your monthly expenses to accommodate that amount.

Example:

To achieve a savings goal of 3,000,000,000 VND in 10 years with a starting savings amount of 300,000,000 VND and an expected savings interest rate of 7% per year, you would need to save an additional 14,534,938 VND per month.

You just need to enter the input variables including the desired target savings amount, your current savings, estimated interest rate, and the planned savings duration. The tool will calculate the monthly savings amount needed to reach your savings goal.

The benefits of budgeting and calculating the necessary amount to achieve savings goals

The process of budgeting and calculating the necessary amount to achieve savings goals offers several significant benefits, including:

- Financial control:

- Increase Consistency:

- Creating a Financial Future:

Budgeting helps you maintain personal financial control. You know exactly how much money you need to save and can manage your expenses in a responsible manner.

When you plan and calculate the necessary amount, you create consistency in saving. You have a clear goal and know exactly what needs to be done to achieve it..

Planning for savings helps you build a solid financial future. By saving and accumulating money, you can ensure a stable financial life and have the ability to meet larger goals in the future.

Create a savings plan

To plan your savings and calculate the required amount to achieve your goals, you can consider the following steps:

1. Determine your goals:

- Please specify the specific goals you want to achieve through saving money. This could be purchasing an expensive item, saving for a vacation, or preparing for the future. More specifically, it could be the target amount you want to accumulate.

2. Review income and expenses:

- Evaluate your monthly income and current expenses. This will help you determine the maximum level of savings you can achieve without impacting your daily life. Identify expenses for essential needs and discretionary wants.

3. Budget setting:

- Set a monthly budget for each of your expenses. This helps you control your money and easily identify potential savings. Maintain expenses for essential needs while minimizing or eliminating expenses for short-term wants.

4. Calculate how much to save

- Based on your goals and budget, calculate the amount of money needed to achieve your savings goals. Try to find a reasonable and achievable amount to ensure that you can reach your objectives.

5. Set up a spending plan:

- Identify potential savings opportunities and incorporate them into your monthly spending plan. Consider how you can reduce unnecessary expenses and explore different ways to save money.

Notes when planning spending and calculating the amount of money needed to achieve the goal

When planning your expenses and calculating the required amount to achieve your savings goals, consider the following points:

- Consider your financial capabilities:

- Monitor and adjust:

- Looking for a smart way to save money:

Don't put too much pressure on yourself by setting an unattainable savings goal. Consider your current income and expenses to ensure that you can sustainably meet your savings plans.

Monitor your savings progress and adjust your plan if necessary. Life can change, and it can impact your ability to save. Be flexible and adapt your plan to fit new circumstances.

Don't limit yourself to just cutting expenses; instead, seek smart ways to save money. This can involve seeking out deals, discounts, or taking advantage of other money-saving services.

In addition to bank savings, there are also many other ways to take advantage of idle money through investment activities such as:

- Invest Stock:

- Invest Gold:

- Investment funds:

Investing in the stock market can potentially yield higher long-term profits, but it also comes with equivalent risks. You can buy stocks, bonds, or other financial instruments to generate returns from price appreciation and dividends.

Investing in gold is a popular form of savings that offers benefits such as asset value protection, portfolio diversification, and high liquidity. However, it's important to thoroughly understand the gold market before investing, as well as the risks associated with gold price fluctuations.

For those who want to invest and potentially achieve higher returns compared to traditional savings, investment funds are a popular choice. Investment funds pool money from multiple investors and invest in various assets such as stocks, bonds, real estate, and foreign exchange. However, it is important to have knowledge about different types of investment funds as well as how they operate.

Profit always comes with risk, so knowledge about investment is crucial. Take the time to carefully consider and thoroughly research before making any decisions to invest in any form of savings or investment.

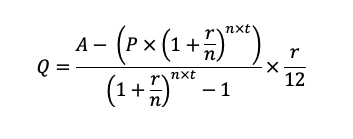

You can refer to the following formula to calculate the monthly savings amount, or you can input the information into a tool to help you quickly plan your savings:

In which:

- Q: The amount of money you need to save each month to achieve your savings goal

- A: Desired savings amount

- P: The initial investment amount you have

- r: Estimated interest rate per deposit term

- n: Number of deposit terms you receive interest in a year

- t: The time period, in years, that you plan to save

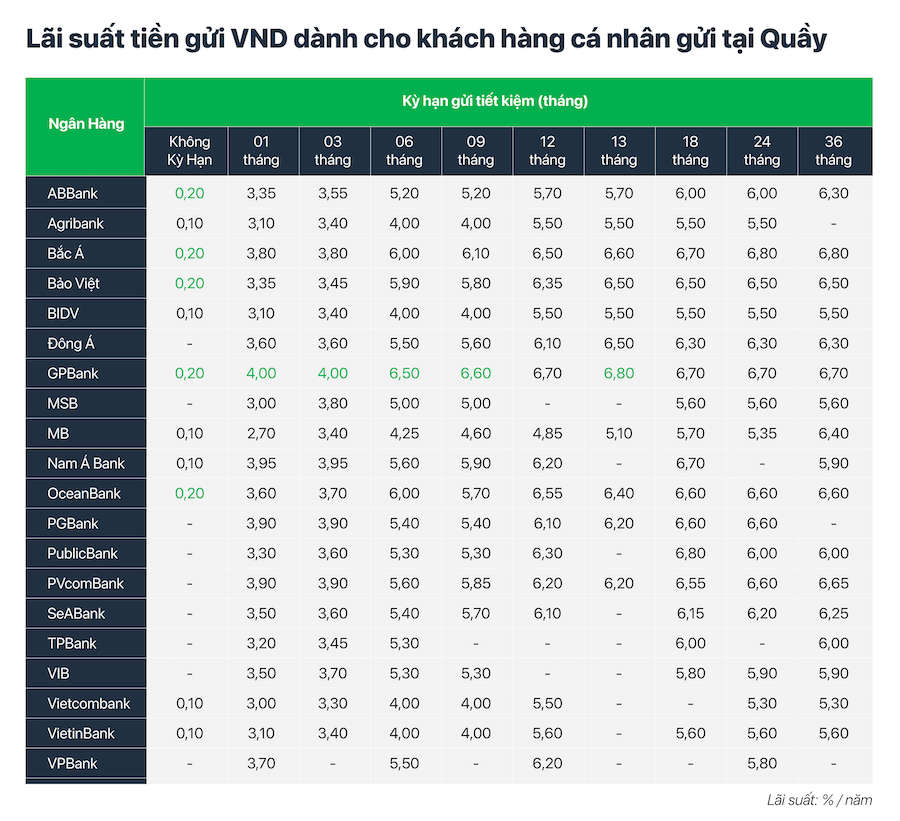

Here is the table of VND deposit interest rates for individual customers at the Counter (updated in 2022) of the most popular banks in Vietnam for your reference:

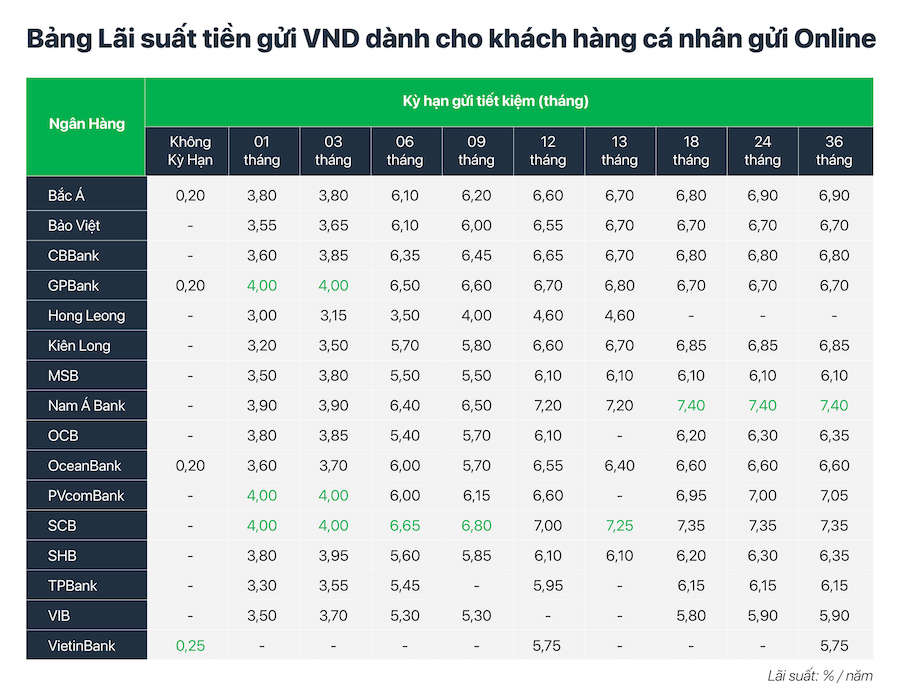

If you don't have time to go to the bank's counter, you can still open an online account right in their mobile banking app. Belowis the table of VND deposit interest rates for individual customers who deposit online (updated in 2022) of the most popular banks in Vietnam that you can refer to.