Compound Interest

Calculator

Apply compound interest, set specific savings goals, and establish a specific time frame for accumulation. Start planning for free today.

You may be interested in The most accurate free savings planning tool.

Compound Interest Calculator

- Compound Interest is one of the most widely used financial tools that helps users calculate interest on the initial principal amount and the accumulated interest from previous periods. This tool is very useful for investors, savers, or anyone interested in calculating the interest amount when investing.

- From now on, with CareerViet's compound interest calculator, you can calculate and predict the compound growth of your savings or investments over a certain period of time.

What is Compound Interest?

- Compound Interest (also known as accrued interest) is a financial concept used to describe the calculation of interest on the initial principal amount and the interest accumulated from previous periods.

- When investing in a sum of money and receiving interest, that interest is added to the initial principal amount to create a new sum that earns more interest. In compound interest, the interest is calculated on the initial principal amount plus the interest accumulated from previous periods.

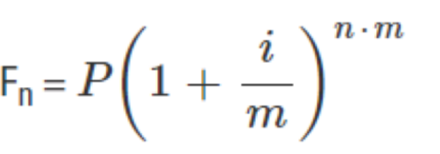

Formula for calculating compound interest in mathematics.

Where:

Where:- Fn is the value of the investment over a period of n years that you receive.

- i is the annual interest rate of the investment.

- i For example, if the interest rate is 10% per year, then i is understood to be 0.1.

- n is the number of years you plan to invest.

- m is the number of times interest is compounded in a year, if interest is received annually, then m is 1.

This formula allows you to calculate the amount of accumulated interest after many periods of interest. At the end of each period of interest, the principal and interest earned are added up and used as the principal for the next period of interest.

For example: If you invest 1 million Vietnamese dong with an interest rate of 5% per year, and the interest is paid monthly, the formula for calculating compound interest will be:A = 1,000,000 x (1 + 0.05/12)^(12x1) = 1,051,161 dongTherefore, the amount you will receive after one year is 1,051,161 dong.

The Power of Compound Interest

Compound interest is a very important concept in finance and investment and can have significant benefits for investors. The power of compound interest can be demonstrated through the following points:

- Asset growth: Compound interest can help assets grow quickly. The accumulated interest can be reinvested, thus increasing according to compound interest and helping assets grow faster.

- Time: Compound interest can help assets grow over time. When the accumulated interest is reinvested according to compound interest, it will increase quickly over time and can achieve a significant growth rate.

- Stability: Compound interest can also bring financial stability to investors. Because when money is accumulated and invested according to compound interest, there will be a stable and reliable source of income in the future.

- Retirement planning: Compound interest can also help investors build a solid and sustainable retirement plan. When investing according to compound interest over a long period of time, investors can accumulate a significant amount of money, helping them achieve their financial goals for retirement.

Therefore, compound interest can bring many benefits to investors, helping them build assets and achieve their financial goals.

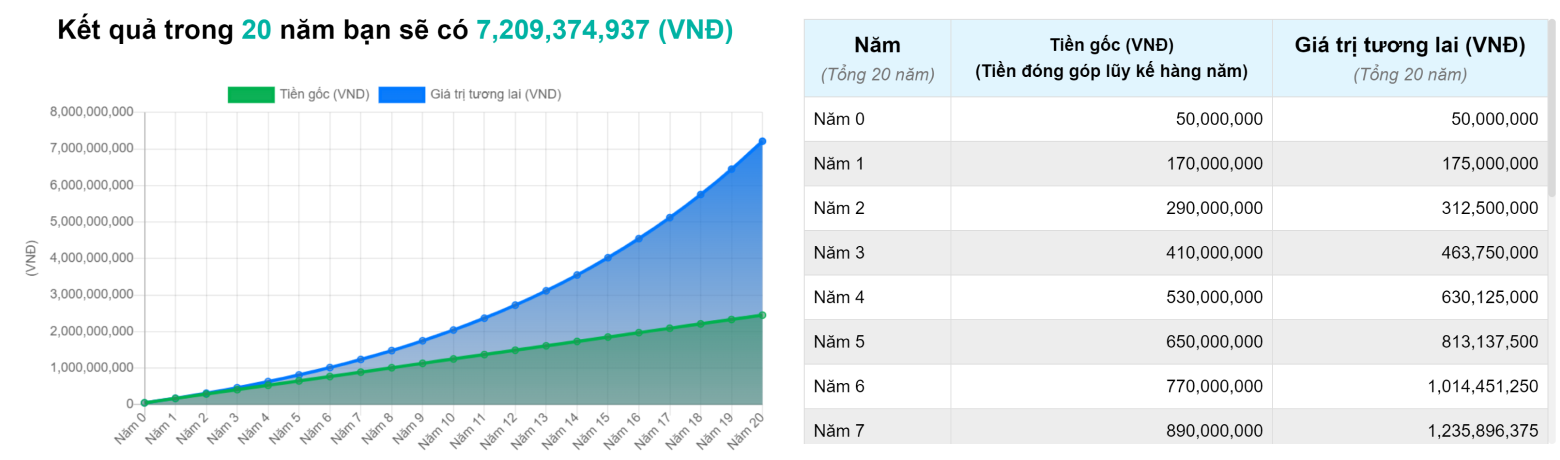

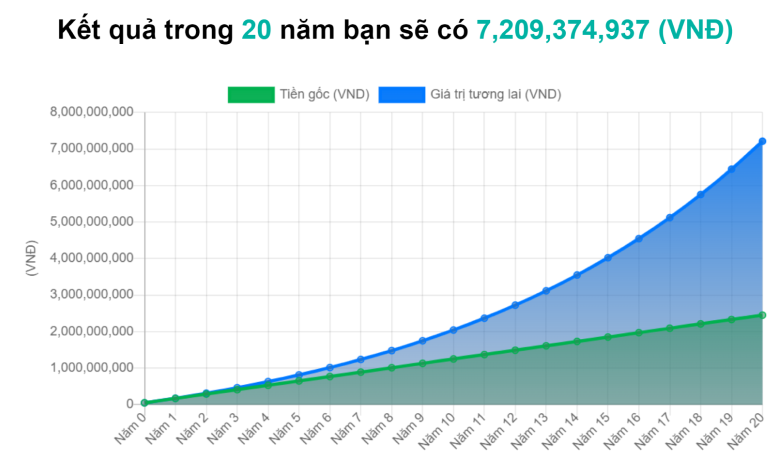

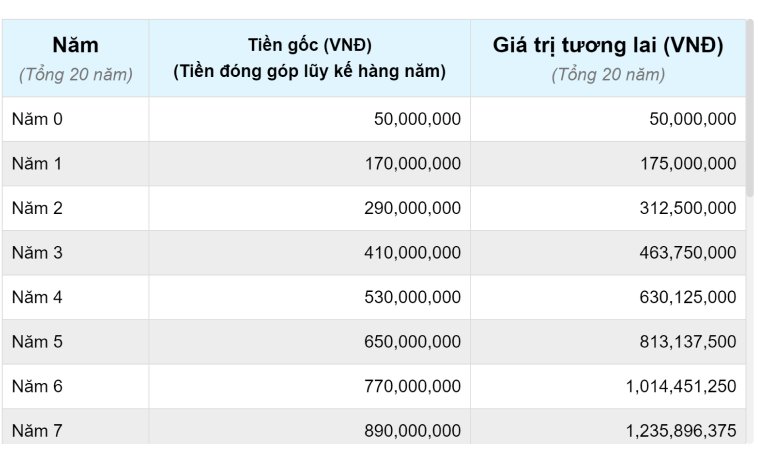

The power of compound interest becomes more apparent when you look at the long-term growth chart below:

This is an example chart of an initial investment of 50,000,000 VND. The assumption is that the investment time is 20 years at a rate of 10% per year. When comparing the benefits of compound interest versus simple interest or no interest, it is clear that compound interest can help increase the value of your investment.

CareerViet - is a provider of simple, fast, and accurate online compound interest calculators.

With our compound interest formula, you can easily and accurately calculate compound interest based on the principal amount, interest rate, and investment time. Just enter the necessary parameters into our calculator, and we will calculate and provide you with an accurate result of compound interest.